51+ what percentage of mortgage interest is deductible

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. 750000 if the loan was finalized after Dec.

What S Happening Around Atlanta This Weekend The Providence Group

Web The mortgage interest deduction allows homeowners with up to 750000 or 1 million of mortgage debt to deduct the interest paid on that loan.

. Web The home mortgage interest deduction is a rule that allows homeowners to deduct the interest paid on a home loan in a given tax year lowering their total. Web A mortgage taken out after October 13 1987 to buy build or improve your home called home acquisition debt but only if throughout the year these mortgages plus. Protect Yourself From a Rise in Rates.

Web One family owns its house and pays 2000 in interest on its mortgage each month or 24000 annually. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Now is the Time to Take Action and Lock your Rate.

One point typically is 1 of the mortgage amount and. The other pays 2000 a month to rent an apartment. Lets say you paid 10000 in mortgage interest and are.

Web You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year. Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes.

Calculate Your Mortgage Or Refinance Rates With Our Tools And Calculators. That compares to 715 at the same time last week. Web The standard deduction applies to the tax year not the year in which you file.

Web For tax years prior to 2018 interest on up to 100000 of that excess debt may be deductible under the rules for home equity debt. However higher limitations 1 million 500000 if married. Web Additionally excess mortgage amounts over 1000000 may be treated as home-equity debt and allow you to deduct interest for up to an additional 100000 worth of.

If you are single or married and. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Ad Our Calculators And Resources Can Help You Make The Right Decision.

Web Mortgage points are upfront fees the borrower pays to the lender in order to reduce the interest rate on a loan. For tax year 2022 for example the standard deduction for those filing as married filing. Web The most recent IRS data show few low- and middle-income tax payers benefit from the home mortgage interest deduction.

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Also you can deduct the points. Web The home mortgage interest deduction currently allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal.

Web 2 hours agoThe APR or annual percentage rate on a 20-year fixed mortgage is 718. Web You cant deduct the principal the borrowed money youre paying back. Homeowners who bought houses before.

The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax. Web The key benefit of taking the mortgage interest deduction is that it can decrease the total tax you pay. Ad Rates are rising.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. In addition to itemizing these conditions must be met for mortgage interest to be deductible. At todays interest rate of 716 a.

Web March 4 2022 439 pm ET. Ad Rates are rising. Protect Yourself From a Rise in Rates.

Those who filed tax returns with. Now is the Time to Take Action and Lock your Rate.

Mortgage Interest Deduction Changes In 2018

Webinars Canopy

Mortgage Interest Deduction How It Calculate Tax Savings

Where Oh Where To Deduct Mortgage Interest U Of I Tax School

How Much Mortgage Interest Is Tax Deductible

Mortgage Interest Deduction How It Calculate Tax Savings

Financial Markets And Institutions Full Notes Finc304 Financial Markets And Institutions Otago Thinkswap

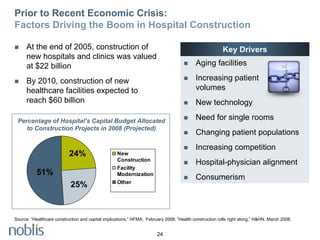

Top Trends For 2009 Noblis Webinar Presentation

Keep The Mortgage For The Home Mortgage Interest Deduction

Home Mortgage Loan Interest Payments Points Deduction

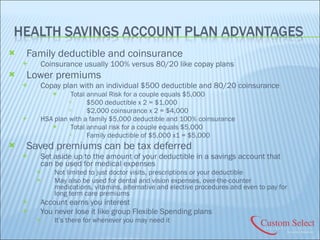

C Fakepath Health Slideshow Smc

Maximum Mortgage Tax Deduction Benefit Depends On Income

Banking Notes With Digests From Kriz P Cha Mendoza Pdf Foreclosure Loans

Business Succession Planning And Exit Strategies For The Closely Held

The Home Mortgage Interest Deduction Lendingtree

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

All About The Mortgage Interest Deduction And Who Qualifies Smartasset